Updated: March 4, 2025

In today’s globalized world, the production and assembly of laboratory equipment and its components transcend national borders. The United States, a major market for scientific and medical instruments, relies heavily on international supply chains, with China, Mexico, and Canada being three of its most prominent trade partners.

In a significant development, President Donald Trump announced that, effective today, the U.S. has imposed a 25% tariff on imports from Canada and Mexico, with Canadian energy products subject to a 10% tariff. Additionally, tariffs on Chinese goods have been increased to 20%. These measures aim to address concerns related to illegal immigration and drug trafficking, particularly fentanyl, while also seeking to rebalance trade and encourage domestic manufacturing.

The financial markets have reacted negatively to these developments, with the S&P 500 experiencing a 2% drop amid fears of escalating trade tensions and potential inflationary effects. Both Canada and China have announced retaliatory tariffs on U.S. goods, further contributing to the uncertainty in global trade relations.

Given the dynamic nature of these tariff policies, the laboratory equipment sector faces potential challenges, including increased costs and disruptions in supply chain logistics. This article explores the roles of China, Mexico, and Canada in the lab equipment industry, examining the types of equipment produced, quality considerations, and the evolving trade policies that shape the modern laboratory marketplace.

- China’s Role in Lab Equipment Manufacturing

1.1 Overview of China’s Manufacturing Capabilities

China has long been recognized as a manufacturing powerhouse, not just in consumer goods but also in specialized laboratory and scientific equipment. Chinese factories produce a wide range of items, from simple glassware like test tubes and beakers to advanced electronic instruments such as spectrophotometers, laboratory centrifuges, and precision scales. Several factors drive China’s capacity in this realm:

- Economies of Scale: Chinese manufacturers often operate large-scale facilities, enabling them to produce laboratory goods in high volumes, which lowers per-unit costs.

- Infrastructure: China’s well-developed manufacturing infrastructure and extensive supply chain networks support a streamlined process from raw materials to finished lab equipment.

- Skilled Workforce: Over the decades, China has developed a skilled labor force capable of producing both low-tech and high-tech scientific instruments.

1.2 Types of Chinese-Made Lab Equipment

- Basic Laboratory Glassware

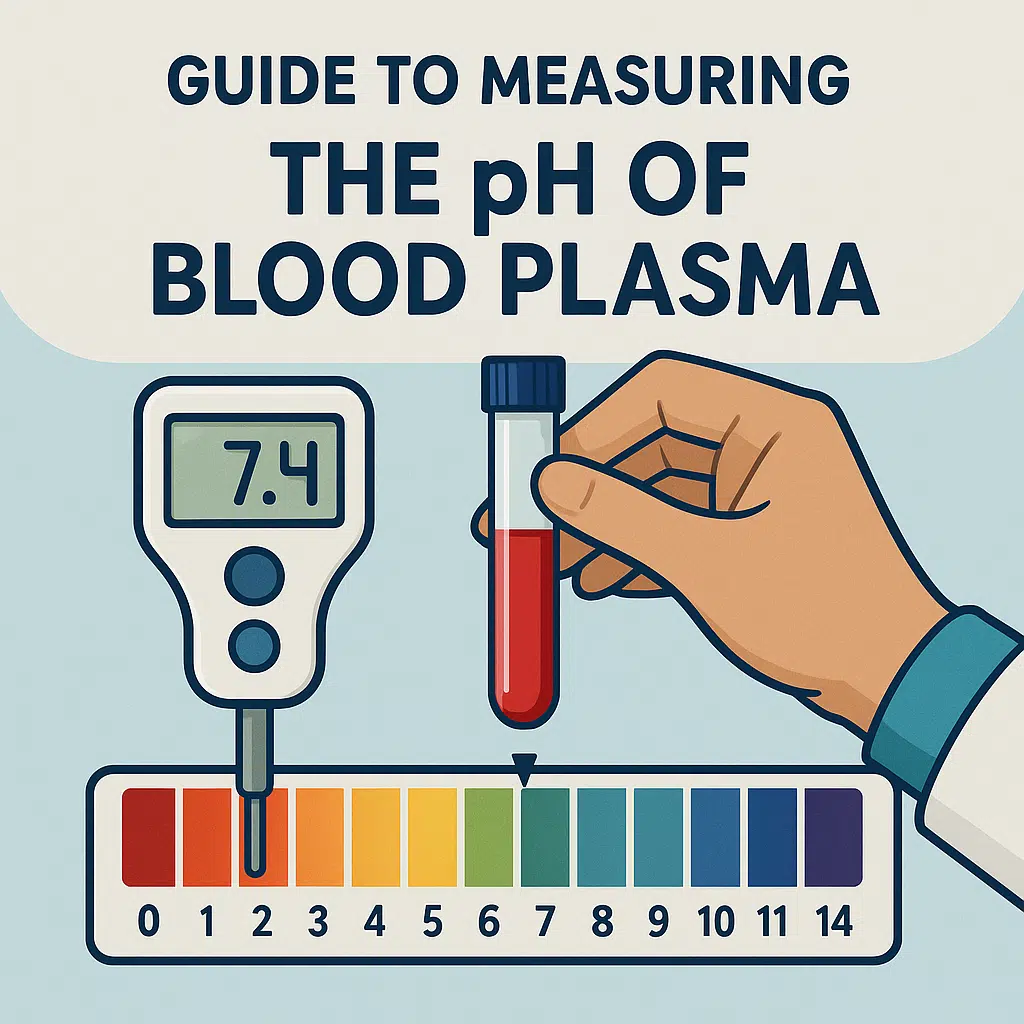

From flasks and test tubes to burettes and pipettes, Chinese glassware often meets international quality standards (e.g., ISO, ASTM). Many U.S. distributors source glassware from China due to its competitive pricing and consistent quality control, though the brand name might be American. - Precision Instruments

China is home to factories that produce electronic balances, pH meters, and spectrophotometers. Some of these instruments are exported to American companies, which may rebrand or incorporate these components into final products. - Medical Laboratory Equipment

Items like centrifuges, incubators, and autoclaves are also manufactured in China. In recent years, Chinese companies have focused more on quality assurance and innovation to compete with established Western brands.

1.3 Components Made in China for U.S. Assembled Equipment

China’s contribution often goes beyond finished products. Components such as circuit boards, LCD panels, sensors, and specialized electronic chips used in American lab equipment are frequently sourced from Chinese factories. While exact figures vary year to year, estimates suggest that a substantial portion—sometimes cited as 25–40% of electronic components in U.S.-branded scientific instruments—originate in China. This highlights the interdependence of the U.S. and Chinese markets in producing lab technologies.

1.4 Quality and Regulatory Considerations

Concerns about quality control and regulatory compliance have historically posed challenges. However, many Chinese manufacturers now hold certifications from international bodies like ISO 9001 and ISO 13485 (for medical devices). This trend has improved global perception of Chinese-made lab equipment, though variations in quality still exist between different manufacturers and price points.

- Mexico’s Emergence in Lab Equipment Production

2.1 Overview of Mexico’s Manufacturing Sector

Mexico’s proximity to the United States, combined with strong trade agreements (notably the United States-Mexico-Canada Agreement, or USMCA), has made it an attractive location for manufacturing, including scientific and laboratory equipment. Over the last two decades, Mexico has diversified beyond automotive and electronics to include more specialized goods.

2.2 Types of Lab Equipment Produced in Mexico

- Plastic Ware and Consumables

Mexico produces items such as pipette tips, microcentrifuge tubes, and other disposable plastics commonly used in biotechnology and pharmaceutical labs. These products often have lower shipping times and costs when destined for the U.S. market, owing to the shared border. - Metal Parts and Fabrications

Many U.S.-based lab equipment manufacturers outsource the machining and fabrication of metal parts—like frames, housings, and stands—to Mexican facilities. This is partly due to Mexico’s skilled labor in metalworking and the cost advantages offered by nearshoring (production closer to the U.S. market). - Medical Device Assembly

Some of Mexico’s industrial zones specialize in medical device assembly under cleanroom conditions. These zones employ stringent quality control measures that meet FDA and other international standards, making them suitable for manufacturing components of lab equipment like infusion pumps or specialized diagnostic machinery.

2.3 Components Made in Mexico for U.S. Equipment

Many U.S.-based lab equipment companies establish maquiladora operations in Mexico, where components are produced or partially assembled before final assembly in the United States. According to some estimates, Mexico accounts for around 10–20% of parts and sub-assemblies for U.S. medical or scientific equipment, although the exact figure fluctuates based on annual trade data. The arrangement reduces logistics costs and allows for just-in-time (JIT) delivery to U.S. assembly plants.

2.4 Quality Standards and Certifications

Mexico’s manufacturing facilities typically adhere to recognized standards such as ISO 13485 for medical device manufacturing. The emphasis on quality and traceability in medical and laboratory sectors is critical, as errors or subpar components can compromise research results or patient safety. As a result, Mexico’s established compliance culture and regulatory oversight make it a reliable partner for U.S. lab equipment brands.

- Canada’s Contribution to Lab Equipment and Components

3.1 Overview of Canada’s Manufacturing Base

Canada shares a deeply integrated trade relationship with the United States. This robust partnership extends into the biomedical and scientific research fields. While Canada’s population is smaller than that of Mexico or China, it maintains advanced research and manufacturing infrastructure, particularly in provinces like Ontario and Quebec.

3.2 Types of Lab Equipment Produced in Canada

- Analytical and Diagnostic Devices

Canada is home to several high-tech firms specializing in analytical instruments, including gas chromatography systems, mass spectrometry instruments, and laboratory automation solutions. These devices are often exported worldwide, including to the United States. - Biotechnology Instruments

With a strong biotech sector, Canada produces specialized equipment like DNA sequencers, PCR machines, and cell counters. Canadian research institutions and start-ups frequently partner with domestic manufacturers to develop cutting-edge tools that eventually reach global markets. - Environmental Testing Equipment

Canadian companies also produce air and water quality testing instruments. Given Canada’s focus on environmental science, it’s no surprise that robust and accurate testing equipment is a significant part of the manufacturing base.

3.3 Components and Parts Shipped to the U.S.

Canada’s role in the supply chain often involves providing high-quality components—such as precision machined parts, high-grade sensors, and advanced software solutions—to U.S. firms. Proximity and shared standards streamline this collaboration. Reports from industry associations indicate that Canada supplies an estimated 15–25% of certain specialized components for U.S.-assembled high-end lab equipment, though these numbers can vary widely depending on the sector and year.

3.4 Regulatory and Quality Landscape

Canadian manufacturers typically meet stringent U.S. regulatory standards (such as those enforced by the FDA for medical devices) and international norms (ISO 9001, ISO 13485, etc.). The long-standing trade relationship under USMCA ensures that many Canadian manufacturers are well-versed in cross-border shipping documentation, customs regulations, and certification processes required for exporting lab equipment and parts.

- Cross-Border Supply Chain Dynamics

4.1 The United States’ Reliance on Global Partners

The U.S. lab equipment market, valued at billions of dollars annually, is highly dependent on global inputs. Firms in the U.S. that design and assemble advanced lab equipment increasingly rely on international supply chains to remain competitive. While the U.S. is home to numerous high-tech manufacturers, the cost advantages, specialized capabilities, and logistical benefits of sourcing from China, Mexico, and Canada make the supply chain truly international.

4.2 Trade Data and Notable Statistics

Finding precise, publicly available data on the percentage of foreign-made components in U.S.-assembled lab equipment can be challenging because these figures are often aggregated under broad categories like “medical devices” or “electronic instruments.” However, several rough estimates provide a window into these relationships:

- Imports from China: Some industry analysts suggest that China accounts for up to 30–40% of electronic components in many types of U.S.-assembled lab instruments, especially those incorporating LCD screens, sensors, or circuit boards.

- Imports from Mexico: Under the maquiladora system, Mexico supplies approximately 10–20% of components for certain medical and lab equipment categories.

- Imports from Canada: Canada contributes approximately 15–25% of high-end, specialized parts—especially in areas related to biotech and environmental testing equipment—to U.S. manufacturers.

These figures highlight the interconnected nature of lab equipment manufacturing, though they may vary significantly based on the specific product segment and fluctuations in trade policies.

4.3 The Role of USMCA in Streamlining Trade

USMCA (the updated NAFTA) has played a key role in simplifying cross-border transactions among the United States, Mexico, and Canada. Reduced tariffs and streamlined customs procedures have encouraged manufacturers to optimize supply chains, often distributing processes like component fabrication, assembly, and packaging across different plants located in each country.

4.4 Quality Assurance Across Borders

Regardless of where the components are made, American companies and regulators (like the FDA and OSHA) maintain strict quality standards for lab and medical equipment. This often requires:

- Audits and Inspections: U.S. companies frequently audit foreign manufacturing sites to ensure they meet rigorous quality metrics.

- Certification Requirements: Manufacturers must comply with ISO or other relevant international standards, ensuring product safety and reliability.

- Traceability: Components are documented and tracked throughout the production process, which is critical for recalls or quality control checks.

4.5 Impact of Newly Passed U.S. Tariffs on Mexico, Canada, and China

In an effort to address trade imbalances and protect domestic industries, the United States recently introduced a series of new tariffs targeting various imported goods, including some categories relevant to laboratory equipment and components. While the specifics of these tariffs can change rapidly based on political negotiations and legal challenges, the latest measures include:

- Tariffs on Chinese Electronics and Precision Components

Building upon the earlier Section 301 tariffs imposed during the U.S.-China trade disputes, new measures introduce or extend duties on certain electronic components, including specialized circuit boards and LCD panels frequently used in lab equipment. The tariff rates range from 7.5% to 25%, depending on the specific Harmonized Tariff Schedule (HTS) classification. Lab device manufacturers reliant on Chinese-made circuit boards, sensors, or chips are now facing higher costs, which could translate into increased prices for end users in the U.S. - Steel and Aluminum Tariffs Affecting Mexico and Canada

While steel and aluminum tariffs have been on the radar for several years (under Section 232 actions), the latest round reintroduces or expands certain tariffs for partner nations. In some cases, a 10% tariff on aluminum and a 25% tariff on specific steel products from Mexico and Canada have been reinstated. This directly impacts the cost of metal frames, stands, and enclosures for laboratory instruments manufactured just across the border. Manufacturers who had relied on duty-free or reduced-tariff arrangements now must factor these additional costs into their supply chain decisions. - Targeted Tariffs on Medical and Lab Consumables

Although the lion’s share of new tariffs focuses on higher-value components, there are reports that some plastic consumables and medical device parts imported from Mexico and Canada will face new duties ranging from 5% to 10%. This affects plastic ware such as pipette tips and microcentrifuge tubes if they fall under certain HTS codes identified by U.S. trade authorities. - Exemptions and Quotas

In parallel with these tariffs, the U.S. has introduced or modified specific quota systems allowing limited volumes of goods to enter at lower duty rates. Some manufacturers may apply for exemptions by demonstrating the unavailability of equivalent materials or components domestically. However, the approval process can be lengthy and uncertain.

Effects on the Lab Equipment Supply Chain

- Increased Production Costs: As importers absorb higher duties on key components, the net effect can be a more expensive end product. For instance, a 25% tariff on a critical circuit board can dramatically increase the cost of a spectrophotometer or a centrifuge, often leaving manufacturers with a tough choice: absorb the cost or pass it on to customers.

- Supply Chain Realignments: Some U.S. manufacturers are now searching for alternative suppliers in other regions—Southeast Asia or Eastern Europe, for example—to circumvent tariffs on Chinese goods. Similarly, Mexico and Canada might diversify their sources of raw materials if steel or aluminum imports come under tighter restrictions.

- Uncertainty in R&D and Innovation: Start-ups and smaller biotech firms reliant on affordable lab equipment or specialized foreign components may delay or reduce their R&D investments due to budget constraints triggered by higher equipment costs.

- Long-Term Shifts in Manufacturing: Over time, these tariffs could encourage more nearshoring or reshoring (moving production back to the U.S.) if the cost gap narrows. However, building new manufacturing infrastructure domestically is a lengthy and capital-intensive process, so immediate large-scale shifts are unlikely.

Response from Stakeholders

- Industry Lobbying: Trade associations representing medical and scientific instrument manufacturers are actively lobbying for more nuanced tariff schedules, arguing that blanket duties harm competitiveness in high-tech industries that require specialized components not easily found in the U.S.

- Negotiations and Revisiting Tariffs: Diplomatic talks between the U.S. and its trade partners might lead to partial rollbacks, revised quota levels, or exemptions for critical lab equipment components. However, any resolution will likely be incremental and subject to broader political considerations.

- Future Trends and Considerations

5.1 Shift Toward Diversification

Recent global events, including the pandemic and geopolitical tensions, have prompted many U.S. companies to consider diversifying their supply chains. Some firms are exploring “China+1” strategies, where they continue to source from China but add another manufacturing base—often Mexico or Southeast Asian countries—to reduce risk. Similarly, Canada’s stable political climate and high-quality standards make it an attractive partner for specialized, high-value components.

5.2 Potential Increase in Nearshoring

The concept of nearshoring—moving manufacturing closer to the U.S. market—has gained traction. Mexico and Canada stand to benefit from this shift as American companies look to shorten transit times, reduce transportation costs, and mitigate supply chain disruptions caused by long-distance shipping. Over time, we may see an increase in the volume of components produced in these neighboring countries.

5.3 Technological Advancements

As laboratory equipment grows more technologically sophisticated, demand for advanced sensors, AI-driven diagnostics, and automation components will likely rise. China’s strong electronics sector, Mexico’s growing tech manufacturing clusters, and Canada’s R&D expertise suggest all three nations will continue playing crucial roles in next-generation lab instrumentation.

5.4 Regulatory Harmonization

With ever-evolving international regulations, alignment on standards for medical and lab devices remains critical. Ongoing dialogues among regulators in the U.S., China, Mexico, Canada, and other regions aim to streamline certifications, making cross-border equipment sales more straightforward. This harmonization could further integrate the global supply chain, benefiting both manufacturers and end users.

- Conclusion

Laboratory equipment manufacturing is a truly global enterprise, relying on the specialized capabilities and resources of multiple countries. China’s massive production capacity and electronic component industry, Mexico’s cost-effective proximity and maquiladora infrastructure, and Canada’s high-quality, specialized manufacturing all contribute vital pieces to the puzzle.

Although precise data on percentages and dollar values vary, it is clear that the United States lab equipment market would be hard-pressed to meet domestic and international demand without foreign-made products and components. China often provides the critical electronic and mechanical components, Mexico brings cost-effective plastic ware and metal fabrication (plus increasingly complex sub-assemblies), and Canada contributes advanced, high-value parts and entire instruments in fields like biotechnology and environmental testing.

As global economic landscapes shift, trade agreements evolve, and technology accelerates, the relationships among these four countries—China, Mexico, Canada, and the United States—will continue to adapt. Nonetheless, the underlying principle remains: collaboration across borders fuels innovation, cost-efficiency, and the continuous improvement of the vital tools and instruments that power modern laboratories. The next time you see a piece of equipment branded as “Made in the USA,” chances are it has a multinational lineage—an amalgamation of expertise and resources from across the globe. This international synergy is what keeps labs running and drives scientific progress forward.

- Potential Impact on Equipment Prices for U.S. Buyers and Purchasing Suggestions

With shifting trade policies, newly imposed tariffs, and global supply chain adjustments, U.S. buyers of laboratory equipment should expect a range of effects on pricing and availability:

7.1 Expected Pricing Fluctuations

- Short-Term Increases: Tariffs on essential components—such as circuit boards, sensors, and even basic consumables—may lead to immediate price hikes from distributors or manufacturers who are unable to absorb the new costs.

- Long-Term Adjustments: Should trade tensions persist, manufacturers may relocate operations or source components from alternative countries. While this could eventually stabilize or lower costs, the transition period may come with additional expenses tied to the complexities of establishing new supply chains.

- Volatile Market Conditions: Rapid changes in tariff rates or exemptions can create unpredictable shifts in pricing, prompting distributors and manufacturers to adjust quotes and catalog prices with limited notice.

7.2 Suggestions for U.S. Purchasers

- Negotiate Volume Discounts

Larger, consolidated orders might give you stronger bargaining power with suppliers. By placing higher-volume orders less frequently, you may offset some of the added tariff-related costs through bulk discounts or preferential pricing structures. - Consider Alternative Brands or Suppliers

Many labs traditionally stick to a small set of well-known brands. However, with supply chain disruptions and price volatility, exploring newer or lesser-known manufacturers—especially those that have diversified supply chains—could reveal competitive pricing without sacrificing quality. - Explore Refurbished Equipment

In certain cases, refurbished or second-hand lab equipment meets quality standards for many applications. Purchasing certified refurbished devices can be significantly more cost-effective and less susceptible to tariffs, as these units are often already in the U.S. market. - Build Strategic Relationships with Distributors

Working closely with trusted distributors can help you stay ahead of sudden price shifts. Distributors often have more leeway in adjusting margins and may provide alternative product lines at reduced rates, especially if they maintain multiple supplier relationships. - Monitor Regulatory Changes and Exemptions

Keep an eye on evolving trade policies and consider whether certain lab consumables or instruments might qualify for exemptions. By staying informed, you can make timely purchasing decisions that minimize duty and tariff impacts. - Plan and Budget for Uncertainty

Given the current climate of fluctuating tariffs and trade negotiations, labs and procurement teams should allocate extra time and budget for equipment procurement. Building a financial cushion into your lab’s budget can mitigate potential cost overruns and ensure crucial research or diagnostic activities continue uninterrupted. - Buy American-Made Products

Purchasing domestically manufactured lab equipment is another way to safeguard your budget from sudden tariff-related cost increases. In addition to supporting local industries, American-made instruments often come with reliable customer service, shorter shipping times, and the assurance of high-quality standards.

- Partnering with ARES Scientific

At ARES Scientific, we understand the challenges that U.S. laboratories face in today’s rapidly changing market. From fluctuating tariffs and evolving trade policies to the complexities of sourcing high-quality, cost-effective equipment, our mission is to guide your lab toward the best possible solutions. By leveraging our deep industry expertise, extensive supplier networks, and commitment to personalized service, ARES Scientific can help you:

- Identify the most suitable laboratory instruments and consumables to meet your specific research or diagnostic needs.

- Explore innovative solutions that balance performance requirements, regulatory compliance, and budget considerations.

- Navigate any tariff-related complications or regulatory shifts, ensuring timely delivery and consistent support.

- Optimize your procurement strategy through volume discounts, refurbished options, and flexible financing models.

Additionally, ARES Scientific carries a wide range of U.S. lab equipment manufacturers, including Animal Care Systems, Corepoint, Alternative Design, Gruenberg, Consolidated Sterilizers Systems, Sentry Air Systems, Euthanex, Baker, Mopec, SE Labs, and TOMI, plus many more. Purchasing these domestically produced products can help labs avoid many of the cost implications associated with international tariffs while still securing cutting-edge, reliable instruments.

Whether you’re seeking advanced analytical instruments or everyday consumables, ARES Scientific is dedicated to being your trusted lab equipment partner. Our goal is to help you select the most efficient, high-quality tools available—while working within your financial constraints—so your lab remains competitive and productive in a dynamic global environment.